We’re pleased to share a new book authored by Perry Douglas on Caribbean development titled “Applied intelligence – A Renaissance in New Thinking for Caribbean Prosperity in the 21st Century.”

You can find it on Amazon here.

We’re pleased to share a new book authored by Perry Douglas on Caribbean development titled “Applied intelligence – A Renaissance in New Thinking for Caribbean Prosperity in the 21st Century.”

You can find it on Amazon here.

Guest Contribution by The Inclusive Agenda

“The future of growth and prosperity of the region must be underpinned by efficient, well-functioning, transparent institutions.”

Perry Douglas, The Inclusive Agenda

In mid-2020, Alan McIntosh, founder of Emerald Investments, sent a letter to the Prime Minister of Barbados in which he advised people not to invest in Barbados. The letter appeared soon after the Prime Minister of Barbados the Hon. Mia Mottley appeared in a Business Post article, and on TV promoting increasing economic links between Ireland and her country. Mottley also appeared on Irish radio and numerous other forms of media to talk about her “work from Barbados” initiative.

Copies of the letter were also sent to multiple media outlets in the UK, “The Times”, “The Independent”, “Sunday Independent Ireland” and more, and of course, the story made its way onto social media: Twitter and Facebook, building all kinds of narratives along the way.

Therefore, what could possibly motivate a wealthy European investor, and highly respected businessman, to write such a letter?

From what the letter says, McIntosh made a US$2.5M investment in a Barbados hotel project about four years ago. He then ended up filing an action against Hotelier Peter Odle, for breach of contract, the individual he loaned the money to. The investment was in relation to “The Sands Barbados” hotel, led by Mr. Odle. Emerald Investments started formal legal action in 2018 against Odle, who had signed a personal guarantee.

This letter clearly reflects McIntosh’s exacerbation with the situation: “I am an Irish investor who invested in Barbados, and I wish I’d never done so. Unless changes are made to the legal system in Barbados, I would urge no one to invest in Barbados, either commercially or to buy a condo, holiday home or even take a holiday there. Why? The legal system is not fit for foreign investment or even to settle minor disputes promptly.”

McIntosh went on to say: “I have waited for the court system to allow me due process, and after almost three years have seen no progress in the courts whatsoever.”

“My advice to anyone contemplating investing in Barbados is: “Do not Do It.”

Now, imagine for a moment, that you are a potential investor in the UK or elsewhere in the world, or even a potential vacationer to Barbados, other Caribbean islands, with thoughts of making a business investment, purchasing a vacation home, or condo?

After hearing that “the legal system is not fit for foreign investment,” and said by a multi-millionaire businessman, co-founder of Irelands biggest home builder, Cairn Homes, owner of the Radisson Hotel at Dublin Airport, the Fleet Hotel in Dublin City centre, and numerous other property holdings. It would defy logic or common sense for one not to heed such a dire warning, and from such a credible source. You might ask yourself, how am I supposed to stand a chance as a small investor, if this powerful and sophisticated businessman can’t even get a day in court to settle a basic commercial dispute?

The story reached Canada, the US, Europe, even Asia and Africa. In the digital age, all stories are global.

Of particular note, the story was also published on “AfricaBrief”, a digital business and investment news platform in Africa. It so happens that Mottley is trying to court wealthy African’s to invest in Barbados. This story is a blow to her efforts because wealthy African investors traditionally look to move their capital out of the inefficient, corrupt home jurisdictions, into safe and reliable ones. The reason why countries like Canada and the UK continue to experience robust property investment markets, via wealthy Asian, African, and Indian investors particularly, is because these destinations are seen as safe, stable counties with transparent and effective governing and legal institutions. Country-specific risk scenarios are a primary factor in investment decisioning; perception, real or imagined, about corruption or lacking legal institutions, drive negative investment narratives.

Potential investors take in that information subconsciously through media then make really consequential decisions, consciously, based on the subconscious information they’ve processed. This is how bias is formed and opportunity lost if no counter-narrative is actively applied in the information age.

Negative stories in the digital era often take on a life of their own, permeating exponentially, killing opportunity and economic growth without anyone being the wiser. If governments in the Caribbean are not mindful of the economic impacts of the information/misinformation age, they risk the long-term prosperity of their nations.

The future of growth and prosperity of the region must be underpinned by efficient, well-functioning, transparent institutions. Strong and inclusive institutions are the hallmarks of prosperous societies in the promotion of global trade and commerce. Gaining foreign investor confidence is something all societies must do, both the developed and developing ones.

According to the World Bank, weak political, economic and legal institutions lead to countries operating with high levels of inefficiencies, unable to function, or prosper, which causes suffering for its society foremost. For emerging market economies, inefficiencies drive corruption and can lead to an uneven distribution of wealth as small businesses face unfair competition from larger companies or business people, with established yet dubious connections with government officials. Resources are inefficiently allocated to friends/companies that otherwise would not be qualified to win government contracts, opportunities, or business facilitation, had it not been for relationships with officials. This crony capitalism holds back innovation and entrepreneurship and stifles younger, more educated and talented entrepreneurs from coming up. Wealth then tends to concentrate with the very few and much older “elites” in the society, and the nation remains stuck in a perpetual economic loop of underdevelopment, never reaching its full economic potential.

In 2018, Commonwealth Secretary-General Patricia Scotland said: “Corruption is poisonous, corrosive, vicious and an enemy of sustainable development. It destroys people’s confidence in their leaders, their politicians and their country.” However, currently, five Caribbean countries – the Bahamas, Barbados, St Vincent and the Grenadines, Dominica and St. Lucia – rank amongst the 50 least corrupt countries in the world (out of 180), according to Transparency International’s 2017 Corruption Perceptions Index. So, the news is not bad.

Therefore, without a coordinated response from the government, its leaders are essentially leaving the reputation and economic growth of their countries, not to fact, but to narratives on the internet.

One of the main reasons, Mr. McIntosh has gone to such lengths, is his dismay with the system, not being able to get his case heard in a reasonable time in the Barbados court system. This then fuels his perception that the Barbados political system is inherently corrupt and that Barbadian hotelier, Peter Odle, is being purposefully protected by friends in high places. Odle’s personal friend does happen to be Prime Minister Mottley. So, it is merely a logical connect-the-dots mental process for McIntosh, and other investors watching from afar. We really don’t know if these perceptions are true or not; however, that does not matter. If not countered, perception becomes the prevailing reality! Furthermore, it exacerbates the problem when we learn that in September 2020, Mottley appointed Odle as Chairman of the Barbados Port Authority, (BPI)—a clear patronage appointment, for a friend who helped her in the election.

McIntosh has also made it clear in the letters he’s written to PM Mottley, that he is not asking Mottley to use her influence towards a favourable outcome for him. He simply seeks to advocate for himself in bringing to the PM’s attention, the state of her legal system, and how it is a negative factor for those considering Foreign Direct Investment (FDI) in Barbados. Mottley not responding simply hurts Barbados and the broader CARICOM region’s FDI climate.

In 2019, Foreign Direct Investment (FDI) in the Caribbean, declined 7.8%, which represents a precipitous decline from its highest historical value reached in 2012. Furthermore, the impact of the current COVID-19 crisis has caused a profound reduction in FDI in 2020 and is expected to continue to fall further by at least another 10%, in 2021. Therefore, it is not helpful when these types of stories get out and are not countered. These stories only reinforce bias, preconceived notions, perceptions, and stereotypes of Black people and the region as corrupt and backwards.

To help sustain and stimulate FDI in Caribbean markets, as a base, strong, efficient, active, and transparent institutions must bolster the recovery and future growth agendas. Research shows that FDI is the most critical factor in economic expansion for any society, particularly for developing Small Island States (SIS). SIS without mature, robust, localized global capital markets—building investor confidence becomes even more paramount to a viable future growth existence. If negative public discourse around foreign investors’ losing money, due to local business people hiding behind systems of corruption, or inefficient institutions, and an indolent legal system, this then becomes the prevailing narrative, which investors make decisions off of.

Programs like Citizenship by Investment (CBI,) for example, a program Grenada and other Caribbean states currently operate, have been plagued with an abundance of shady characters over the many years.

Major media outlets have produced non-flattering documentaries about CBI programs throughout the region, a blow to the reputations of these SIS. According to the Economist, the “defenders of the schemes insist that criminals seeking a bolthole are the exception and that they are making great strides in imposing stricter due diligence standards. The vast majority of their customers, they argue, are honest, respectable people with a legitimate hankering.”

Nevertheless, after looking into it, we couldn’t find any reasonably positive CBI story online.

Therefore, the big risk, and future priority towards a positive growth curve trajectory for the region, is the un-branding of the region away from the narrative as a haven for illegal, unscrupulous, criminals. We must control our own narrative, write our own stories, otherwise, others will write them for us. The well-written story that needs to be told going forward should be about well-intentioned, legit investors like Allan McIntosh, Emerald Investments, honestly investing in the region, finding the place efficient, well managed, with strong public institutions that build investor confidence. The story should also go on to say, that McIntosh makes good money on his investments, and creates meaningful amounts of jobs, the enterprise becomes a responsible corporate citizen, contributing to climate change mitigation, specific to the region, and investing in education and skills training programs to prepare the next generation for the future-of-work.

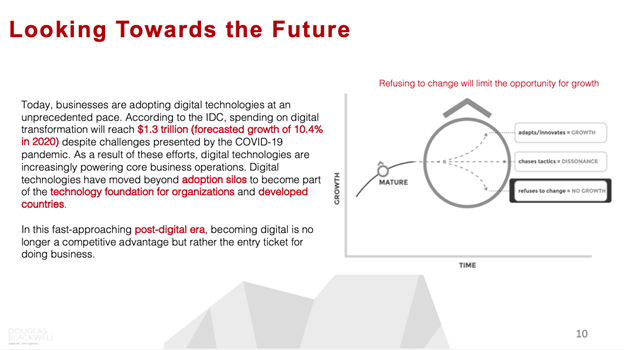

In an era of digital transformation, the world is increasingly competing for limited global investment dollars. Unless the region can become savvier at controlling information and communication narratives, in its favour, valuable investment dollars will end up elsewhere.

Leadership, from islands like Barbados, about public occurrences like the McIntosh/Odle saga, which finds itself closely associated with the Prime Minister, cannot go unaddressed. For example, on social media or in public discourse in the investor community abroad, the story/narrative going around is that Peter Odle is notorious for using political relationships to protect himself from numerous lawsuits. We, of course, do not know if these narratives are true or not, nor can they be substantiated in real-time, but that’s the nature of social media, and if you don’t have your own media strategy in place or story to tell, your image becomes whatever narrative emerges online. Salacious, headline-grabbing stories get more attention and go on to create further unwanted narratives.

This fundamentally works against the efforts of the PM, for example, who is whole-heartedly trying to sell Barbados to the world, with her “work from Barbados” scheme.

However, in the end, while the big boys fight it out publicly, the little guys bear the economic brunt.

I would think it critical and responsible for government to understand precisely, how the new digital playing field works, and that everything comes back to economics in the end. Digital message control and business image strategies are now an essential discipline in order to carve out your place in the digital universe. To have a long-term sustainable economy for the benefit of the people, you must adapt to globalization, and promote your country to the world, this is how the wealth of nations grow.

Perry C. Douglas is an Entrepreneur and Innovator…for Inclusive Caribbean Economies. Read more of his work at his blog The Inclusive Agenda: http://theinclusiveagenda.blogspot.com.

The views and opinions expressed herein are solely those of the guest author and are not necessarily representative of those of the Caribbean Trade Law & Development Blog.

Image by Gerd Altmann from Pixabay

“China’s engagement in the region does not necessarily have to be negative, it could be a big positive for growth… There must be a better more equitable vision for a mutually beneficial operating model, for the management of the relationship with China.“

Perry Douglas

Perry Douglas, Guest Contributor

In the recent article titled: China’s Opaque Caribbean Trail: Dreams, Deal, and Debt by Caribbean Investigative Journal Network (CIJN.), this piece is filled with many examples of the Chinese debt-trap strategy. For Caribbean countries, one of the most visible, expansive, and expensive forms of Beijing’s engagement with the region is its financing of large-scale infrastructure projects. The CIJN investigation unveiled a trail of official secrecy, questionable procurement processes, and the looming threat of potentially insurmountable debt. The Chinese playbook is the same everywhere—huge hotel projects, highways, agriculture projects, even building a Prime Ministers fancy new house. According to CIJN, “China’s Caribbean portfolio is extensive. It includes highways and bridges, housing, energy, mining, air and seaports, tourism projects, hospitals, and even official residences, forming a part of that country’s strategic thrust into Latin American and the Caribbean.”

The investigating team uncovered, that in most cases, the precise terms of agreements are not routinely publicized, the procurement processes and concessions are a mystery. The Chinese often end up with all the labour contracts, and their labour practices lack adherence to any type of building code and other health and safety standards.

A 2012 independent forensic audit of the Jamaica Development Infrastructure Programme (JDIP) and the Palisadoes Shoreline Protection, and Rehabilitation Works Project concluded there was “non-adherence to allocations approved by Parliament and the Ministry of Finance. There was also the arbitrary issuance of Variation Orders and selection of sub-contractors along with the unprogrammed and arbitrary allocation of funds for institutional strengthening,” according to the audit document.

According to clause 13.3 of the contract ($630 million North-South Highway project signed with China Harbour Engineering Corporation (CHEC) on June 21, 2012):

“The Government shall unconditionally and irrevocably waive any right of immunity (to the fullest extent permitted by applicable law) which it or any of its assets now has or may acquire in the future in any jurisdiction.”

To add insult to injury, the highway deal, in a case study conducted by the Caribbean Development Bank (CDB,) found there was “no way costs could be recouped through toll payments.” Hence, China now said that since the investment couldn’t be recouped through toll payments, land adjacent to the highway should be given as compensation. Jamaica of course had already agreed to those terms in the clause. China of course enforced it and the Chinese company promptly brought in 1000+ workers from China to begin work on a commercial project—free land, no Jamaican worker participation, no contracts for Jamaican firms, no economic benefit to Jamaica.

“New roads, new businesses, new hotels, and booming Chinese immigration has led to many companies being staffed with more Chinese workers than local Bahamians.” Forbes

In practical terms, this meant that the Jamaican state allowed China, in a case of a breach of contract by the Government of Jamaica, or actions that the Chinese have determined results in non-performance, would be actionable on Jamaica’s sovereignty. When contextualized, the clause essentially allows for the GOJ to forfeit any current or future owned assets to China, for debt recovery by seizure. A blatant neocolonialism play and encroachment on sovereignty.

In Trinidad and Tobago, the sudden termination of the Government’s $71.7 million project between China Gezhouba Group International Engineering Company and the Housing Development Corporation (HDC) in 2019 has drawn attention to a lack of transparency in the awarding of the contract, and what has been described as overly generous concessions to this Chinese company.

In Suriname, there are increasingly alarming rising fears that mounting debt to China, spanning decades, can have the impact of stalling future development and exposing the country to liabilities way above its ability to pay.

Economics has never been a morality play; so, it’s not China’s responsibility to look after the interest of our people, it is the responsibility of leaders, in consultation with the people, to lead and look after the interest of their nations. We must be committed to real change, otherwise, nothing will ever change! The highly skilled Chinese negotiators need to be matched with our powerful team of negotiators, weaponized with the tools and resources of Artificial Intelligence and Machine Learning algorithms, and systems that can process and provide actionable solutions at a simple keystroke.

China’s engagement in the region does not necessarily have to be negative, it could be a big positive for growth. Notwithstanding, it will all depend on how we play our cards—understand the historical colonialism playbook of others and develop counter offenses…be proactive, not reactive, and control the narrative. There must be a better more equitable vision for a mutually beneficial operating model, for the management of the relationship with China.

This operating ecosystem must be formattable, backed up by strong executable mechanisms, progressive regulatory environments, compliance, and governance, abiding by sturdy democratic principles…the rule of law, freedom of information, and enhanced transparency, in the context of an anti-corruption agenda.

Assets belonging to the people becoming collateralized property in business deals is beyond the pale, way beyond the bounds of any acceptable actions and behaviour by any government, and it is fundamentally illegal. Sovereignty represents a state’s most precious right and freedom under international law.

“The borrower hereby irrevocably waives any immunity on the grounds of sovereignty or otherwise for itself or its property in connection with any arbitration proceeding…or with the enforcement of any arbitral award pursuant thereto.” Project in Guyana signed on January 9, 2017; in Article 8.1:

“This is Guyana dangerously agreeing to cede sovereignty. It plays into the Chinese strategy of using economic weaponry in the pursuit of influence and domination,” says attorney and chartered accountant Christopher Ram. In short, these governments have signed away their nation’s sovereignty, dignity, and basic self-respect, to China. China could simply walk in and take control of Guyana’s assets through its pre-set “debt trap.”

Very recently, July 2020, a Kenyan Appellate Court halted a construction deal, by pronouncing the $3.2 billion contract between Kenya and China for the construction of the Standard Gauge Railways (SGR,) as illegal. The recent judgment effectively lifted the lid on the “dragon’s debt-trap diplomacy.” China had been pressuring Kenya to pay the huge debt, while in the middle of battling a pandemic.

Since 2013, Kenya has saddled itself with more than $5 billion in loans from China for construction on the project. However, in just its first year of operation, the project reported losses of about $98 million US, making servicing the debt impossible. And of course, the terms of the deal made it such, that if Kenya couldn’t repay, it could end up giving China control over some of its most important assets. In this case, it would have been Mombasa Port, Kenya’s largest and most valuable port in east Africa, the gateway into Kenya and landlocked neighboring nations Burundi, Congo, Rwanda, South Sudan, and Uganda. “Therefore, losing control over the port would mean erosion of Kenya’s sovereignty.” The implications are freighting, thousands of port workers would be forced to work under its Chinese lenders—colonialism would have crept back. Fortunately, Kenya’s court system saved the day, bringing a wakeup call to all those involved in similar entanglements with China. We hope Caribbean leadership took the call!

COVID-19 has provided us with a pause, an inflection point, to shift our thinking and strategy focus towards a better future, we can’t get stuck in the past, behind amateurish politicians, with nothing but stale ideas that have never worked out for the people. If we stand still, we perish; we must move in the same direction the world is moving in or be left behind!

In short, greater investment focus on digital commerce needs to be applied, become the priority. It is counterintuitive to build backward and in line with China’s geopolitical and economic objectives when the rest of the world is moving in another direction.

Domestic success depends on global commerce, but for over 400 years we’ve been on the wrong side of that curve. Digital transformation underpins a prosperity reality and must be the government’s top policy development priority. Resources need to be mobilized with the stated objective being to leapfrog the regional economy into the more prosperous global economy, our ambitions have to be focused, and big! We can’t just sit there, letting others decide our future for us.

We must invest to diversify the entire region to protect our society from future global shocks, as witnessed by the pandemic, which has essentially wiped out the tourism economy. We need diversification and foresight.

If we had a vibrant commerce based agricultural and fisheries industry, for example, with robust global digital sales and marketing capabilities, we would be able to achieve food security and effectively export meaningfully for-profit simultaneously. Pandemic or no pandemic!

A diversified economy is a resilient economy.

A fundamental change in approach and the underlying variables is relative to how development should logically be carried out—a fundamental change in basic thinking, concepts, and practices, highly relevant to the digital era in which we live in, is paramount! Grenada needs a new Investment Policy Statement, a new operating paradigm, one that is progressive, inclusive, with empathy towards sustainable socio-economic development. Politicians should no longer be put in charge of investment decisions, instead, a professional data and applied intelligence-driven performance approach must be taken up immediately! Scientific ecosystems coupled with highly qualified investment committees, responsible to the people, is the push! Driven by intelligent scientific data-based decisioning and predictable modeling, powered by Artificial Intelligence, followed up with fearless implementation and actions, transparent and measurable—is the push! This new paradigm includes an advanced level of due diligence, governance, and transparency, all of which must be brought to the investment decisioning forefront, in examining the probability of desired outcomes in future ‘worlds’ scenarios.

Throughout history, technology-driven economic investment and infrastructure development have driven civilizations to prosperity, always! History shows, through evidence and analysis, that those nations that have deliberately focused on facilitating technology-led growth, went on to forge empires. Today, the world is at another transitioning inflection point, and good decisions taken here can change the directional curvature of prosperity for the entire Caribbean. History shows, like other periods of great technological transition opportunities before it, mishandling it at this critical juncture, will set the entire region back behind the prosperity curve, for generations to come!

The genesis of our future prosperity begins with how we first choose to think! Instinctive and emotional thinking must be put aside for a more slow, deliberative, and logical process—with an entrepreneurial mindset being at the forefront. Increased efficiencies and productivity will increase a nation’s profits and intergenerational wealth curve trajectory, upwards. Growing the standard of living through the development of a highly-skilled, tech-savvy middle-class, throughout the region. This is our best and most optimal opportunity; lets push! Socioeconomic also history tells us that we must resist the intuitive nature of our human condition, towards decision-making processes and choices. Think and focus logically instead, find the data-driven solutions, and put emotions and ego aside. Playing the long game is critical to future success. Decisions based on intelligence gathering and actions are central to good outcomes. Such focused thinking is paramount and can be the genesis of a true Caribbean Renaissance.

Perry C. Douglas is an Entrepreneur and Innovator…for Inclusive Caribbean Economies. Read more of his work at his blog The Inclusive Agenda: http://theinclusiveagenda.blogspot.com.

The views and opinions expressed herein are solely those of the guest author and are not necessarily representative of those of the Caribbean Trade Law & Development Blog.

You must be logged in to post a comment.