Welcome to our Caribbean Trade and Development News Digest covering the week of June 12-18, 2022! A happy Father’s Day to all CTLD Blog readers who are fathers and father figures! We are pleased to bring you the major trade and development news headlines and analysis from across the Caribbean Region and the world from the past week. We do hope you enjoy this week’s edition!

THIS WEEK’S HIGHLIGHTS

It has been a pretty nail-biting week in the world of trade. The biggest development, of course, is that the WTO’s Twelfth Ministerial Conference (MC12) after going into overtime was able to reach outcomes on a package of issues, informally dubbed the ‘Geneva Package’. While there was need for much compromise and some other key things have been left for future work, many commentators laud the outcomes, specifically because they give the WTO a shot of much needed success at a time of growing questions about the organisation’s continued relevance and effectiveness.

The existing e-commerce customs duties moratorium has been extended for two more years, while a TRIPS Waiver was finally agreed but on vaccine production only and for five years. Perhaps most significantly, the WTO has reached an agreement on disciplining fisheries subsidies. Although there have been reservations expressed about the ‘watered down’ nature of the fisheries subsidies agreement, it is only the second multilateral trade agreement concluded in the WTO’s 25-plus year history and has been dubbed, therefore, a needed win for the organisation.

Earlier this month, the Summit of the Americas 2022 saw the announcement of a US climate climate initiative for the Caribbean. Read Ambassador Ron Sanders’ commentary on the Summit here.

The Financial Action Task Force (FATF) held its June plenary. Barbados, Cayman Islands, Haiti, Jamaica remain among the countries listed on FATF’s grey list as of June 2022, while Malta has been removed from that list.

The COVID-19 pandemic and the fall-out from the Russia-Ukraine conflict continue to negatively impact global supply chains, leading to spiralling inflation and rising fuel costs. The Federal Reserve of the US has implemented the biggest interest rate hike since 1994 in an effort to cool the spiralling inflation and prevent a recession.

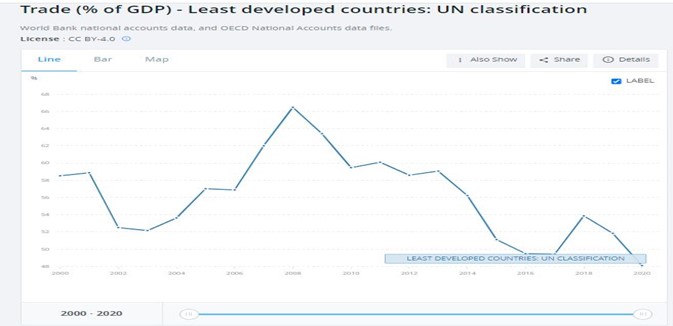

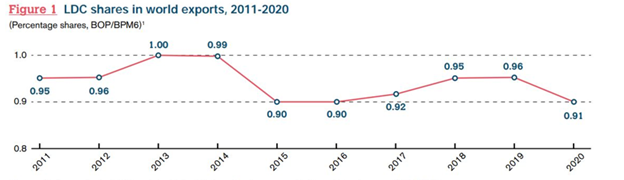

Finally, be sure to read this insightful article by guest contributor Lucius S.J. Doxerie examining the prospects of trade for promoting economic growth in Least developed countries here!

REGIONAL NEWS

Guyana tops list of Britain’s Caribbean trade partners

Stabroek: One of the more recent indicators of external perceptions of the state of health of the Guyana economy was reflected in the pronouncement by British High Commissioner to Guyana, Jane Miller, on Thursday July 2 that Guyana has now positioned itself as Britain’s top trade partner in the Caribbean. Read more

Caribbean and African Development Banks ink deal

Turks & Caicos Weekly: The Caribbean Development Bank and the African Development Bank have joined forces to promote trade between the regions and will work together on the sustainable development of MSMEs. Read more

CDB looking at an integrated logistics transportation system for the region

Barbados Today: The Caribbean Development Bank (CDB) says it is looking at “an integrated logistics transportation system” for the region which would focus on developing various aspects of infrastructure such as ports, roads, farms, storage, warehousing, and standards. Read more

Promoting sustainable fisheries trade in Eastern Caribbean

UNCTAD: Eastern Caribbean island nations Grenada, Saint Lucia, and Saint Vincent and the Grenadines have committed to a regional Blue BioTrade action plan to sustainably harvest and trade queen conch. Read more

Foreign direct investment to Latin America and the Caribbean rebounded by 56% in 2021

UNCTAD: Foreign direct investment (FDI) in Latin America and the Caribbean has rebounded from the pandemic-induced slump, growing by 56% to $134 billion in 2021, according to UNCTAD’ World Investment Report 2022 published on 9 June. Read more

FACT SHEET: Vice President Harris Launches the U.S.-Caribbean Partnership to Address the Climate Crisis 2030 (PACC 2030)

Whitehouse: Vice President Harris announced the U.S.-Caribbean Partnership to Address the Climate Crisis 2030 (PACC 2030). PACC 2030 is the Biden-Harris Administration’s new initiative involving fresh commitments to — and integration of — climate adaptation and resilience and clean energy programs across the Caribbean region. Read more

CARICOM trying to restore correspondent banking – Belize PM

Amandala: At the first official press conference held by the Prime Minister since his being elected into office in November 2020, Hon. John Briceño spoke on several foreign affairs issues concerning the country and the region, including correspondent banking. Read more

Colombia, CARICOM Countries Open Talks to Update Trade Agreement

Finance Colombia: Colombia and the CARICOM member countries (Caribbean Common Market) reported advances during an initial meeting held seeking to deepen the Partial Scope Agreement, in force since 1995. Read more

INTERNATIONAL NEWS

AfCFTA Positive On Intra-African Trade Levels-Survey

East Africa Business Week: For the third year running, the Pan-African Private Sector Trade and Investment Committee (PAFTRAC) have partnered with African Business magazine for the Africa CEO Trade Survey. Read more

WTO strikes global trade deals after ‘roller coaster’ talks

Reuters: The World Trade Organization agreed on the first change to global trading rules in years on Friday as well as a deal to boost the supply of COVID-19 vaccines in a series of pledges that were heavy on compromise. Read more

Commonwealth leaders set to meet for first time in four years

Commonwealth: Leaders from 54 countries will gather in Kigali, Rwanda, this week for the 2022 Commonwealth Heads of Government Meeting (CHOGM), the sixth time the event has been hosted by an African country. The week-long summit is expected to attract over 5,000 participants from government, business, and civil society under the theme ‘Delivering a Common Future: Connecting, Innovating, Transforming’. Read more

NI Protocol: UK reveals plans to ditch parts of EU Brexit deal

BBC: The UK government has published plans to get rid of parts of the post-Brexit deal it agreed with the EU in 2019.It wants to change the Northern Ireland Protocol to make it easier for some goods to flow from Great Britain to Northern Ireland. Read more

EU set to take legal action against UK over post-Brexit deal changes

BBC: The EU is expected to launch legal action against the UK government on Wednesday over its decision to scrap some post-Brexit trade arrangements. Ministers insist current checks on some goods travelling from Great Britain to Northern Ireland must end to avoid harm to the peace process. Read more

EU refuses to rule out suspending Brexit trade deal

Euronews: The European Commission won’t rule out suspending the EU-UK trade deal if the UK approves a draft bill that unilaterally overrides parts of the Brexit agreement. Read more

European Commission backs Ukraine for EU candidate status

Al Jazeera: Commission gives a fast-tracked opinion on membership of the bloc before a summit of EU leaders on June 23-24. Read more

EU signs gas deal with Israel and Egypt

Al Jazeera: The European Union, Israel and Egypt have signed a tripartite natural gas export deal as the bloc seeks to diversify away from Russian energy. Read more

STRAIGHT FROM THE WTO

NEW ON THE CTLD BLOG

The Caribbean Trade & Development Digest is a weekly trade news digest produced and published by the Caribbean Trade Law & Development Blog. Liked this issue? To read past issues, please visit here. To receive these mailings directly to your inbox, please subscribe to our Blog below:

You must be logged in to post a comment.